Sustainability

Inclusive capitalism means that profit and purpose coexist. It's an economic system that works for everyone, and it has been our guiding principle for a decade.

We invest billions of pounds of capital in projects that aim to improve society. This includes low-carbon technology, infrastructure, affordable homes, and support for small businesses. It also means that sustainability is central to how we run our business.

![[Image] 2023 Climate And Nature Report](/media/wy0gh1zi/image-2023-climate-and-nature-report.jpg?center=0.75309417832231385,0.47723497398151632&mode=crop&width=768&height=768&rnd=133565507326130000&format=webp)

Climate and nature report

The purpose of this report is to provide investors and other stakeholders with a better understanding of our business’s exposure to climate-related risks and our strategic resilience to these risks as well as the climate-related opportunities we have identified.

![[Image] 2023 Social Impact Report](/media/rhdhy4pa/image-2023-social-impact-report.jpg?anchor=center&mode=crop&width=768&height=768&rnd=133546495624000000&format=webp)

Social impact report

Legal & General is uniquely placed to make a material difference on a range of social issues. We combine scale, reach and financial strength with the skill, resilience and dedication of 11,500 brilliant people working together.

See how we do it

Building fairer economic growth

Levelling up means supporting the UK’s regeneration, in places that need it most.

Driving business transparency and equity

Our vision is to build a workplace where we can all perform at our best, no matter who we are.

Prioritising health and wellbeing

We believe we have the power and the responsibility to support reduction in health inequalities and therefore invest in the economy.

Quick links

Latest sustainability news

View our climate change videos

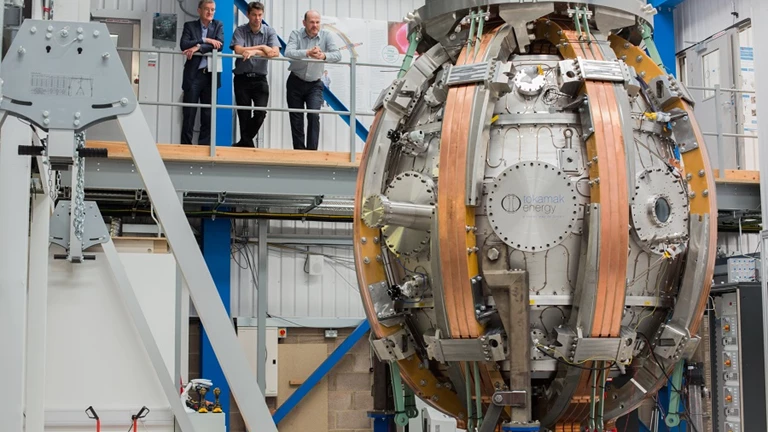

Our clean energy investments

Fusion energy, the answer to our power needs?

Our investment in Pod Point electric charging

Funding more powerful solar

Charging towards a greener future

Reporting centre

Download all of our latest reports, including our Social Impact Report, Climate Report and Carbon emissions reporting criteria.